Our extensive network working for you

It's easy to leverage our national network of financial planning specialists.

We know that you’re busy! Harvest makes it as simple as a phone call or e-mail for your accounting practice to begin your connection to our financial and estate planning experts. Reach out today, let's have a conversation about your clients and practice. From there we can make some recommendations on what type of arrangement would best suit your needs.

Referral Model

- Referral Agreement with Harvest

- Dedicated Advisor(s)

- Dedicated Service Team

- Access to Tools/Training

- 20% of Advisor Compensation

- 20% ownership interest in Client

Partnership Model

- Partnership Agreement with Harvest

- Dedicated Advisor(s)

- Dedicated Service Team

- Access to Tools/Training

- 50% ownership of Corporation

We'll work together to determine the model that's best for your firm. A partnership can offer more long term income possibilities and additional opportunities to engage with your clients, and our simple referral model is a fast, turn-key opportunity to leverage your relationships to generate more income while still serving your clients’ best interests. Connect with us today to learn more about which model will benefit you most.

By working with Harvest under the Referral Model, you could see your referral income grow to over $300,000 in just 5 years*

*Based on 1 insurance at $10,000 average per month & 1 investment client per month at $250,000 average invested

Choose from two powerful programs

You refer your clients to Harvest, and we take care of the rest. It's that simple.

Our Referral Program is perfect if you’re a smaller firm and you’re not sure of potential client uptake. Or, if you’re a firm with a larger client base, leverage our Partnership Program and its unlimited revenue opportunities.

More revenue in less time

Your clients are always treated professionally.

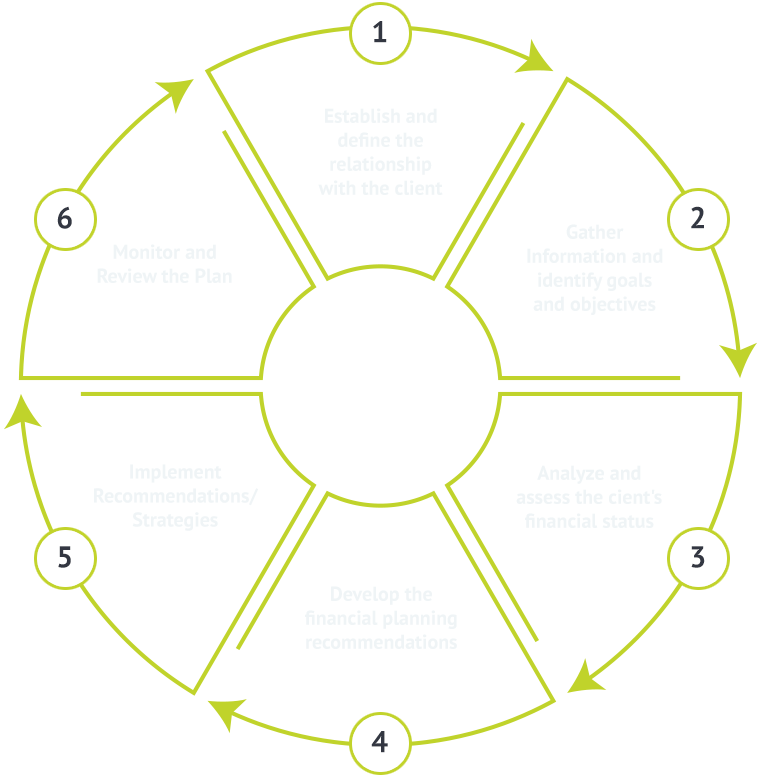

Our success is measured by your clients success. Our proven six-step financial planning process ensures a well thought out strategic plan for your clients and growing referral income for your practice.

Information Center

Frequently Asked Questions

We currently have two models for consideration. We offer a simple referral agreement model as well as a partnership model. Both models have been vetted through various securities, insurance and professional bodies.

Every Harvest advisor is thoroughly vetted by our management team before they are contracted. We've built strong connections with our advisor team over many years and maintain our relationships with them through open communication and trust. They are hand-picked and matched to each practice to ensure you receive the best person to meet the goals of your clients and your firm.

If you are unsatisfied with your advisor, our management team is more than happy to go back to the drawing board and match you with another experienced advisor. Worst case scenario, you always have the option to terminate your agreement at any time, no questions asked.

Yes. You may have a multi-partner practice where some of the partners are already dealing with financial & estate planning advisors. We would be happy to speak with that advisor to determine whether they would be a good fit for Harvest, at which point you would receive the many benefits of being associated with Harvest. Alternatively, we can leave that relationship in place and add other advisors to the team. We are not trying to replace or disrupt the relationship you have with your current advisors. We can support whatever processes your firm already has in place while providing guidance, recommendations and an educated second opinion.

Yes. We provide our partners with a full range of resources, training materials and information to ensure a smooth transition while you update your clients and offer new services in the near future. Soon, we will have an online resource centre that you can pull information from on a regular basis to learn from and share with your clients.

We provide each client with a financial and/or estate plan. These plans often encompass the implementation of investment and/or insurance related strategies and products. To that end, we are licensed to distribute a wide range of investment & insurance products, including:

- Mutual Funds

- GIC’s

- Segregated Funds

- Individual & Group Insurance products (Life, Disability & Health Insurance)

- Annuities

- Health Spending Accounts

While we feel every accounting practice should incorporate financial & estate planning services to their practice, we would expect nothing less than for you to verify the information. That's why we offer open contracts with no time commitment required. Additionally, we personalize every plan and customize it based on the firm because we know that no two accountants or firms are the same. Harvest is built on trust, integrity and expertise — what you will experience from the very beginning.

Our experience tells us that an accounting practice will usually sell for 70% to 125% of ongoing billings. Contrast this to financial and estate planning practice that generally sells for 2 – 4 times ongoing renewals. We guarantee that the portion you own of ongoing renewals will be purchased back by Harvest Financial & Estate Planning for a minimum of 3 times renewals.

While each advisor is chosen for their experience and education, Harvest also reviews every plan for thoroughness and accurateness. In addition, advisors must adhere to the various provincial insurance and investment regulatory requirements as well as their professional code of ethics. Clients are also protected through various organizations, such as:

- Provincial Securities Commission Ombudsman

- Canadian OmbudService for Life and Health Insurance

- Canadian Deposit Insurance Corporation (if applicable)

- Assuris (if applicable)

- Errors & Omissions Insurance

Visit our Contact Us page and give us a call or send us an email. We would love to hear from you!